Merry Crisis (Demo)

After a break-up turns your world inside out, you return home for Christmas hoping the change in scenery will give you space to mend a broken heart.

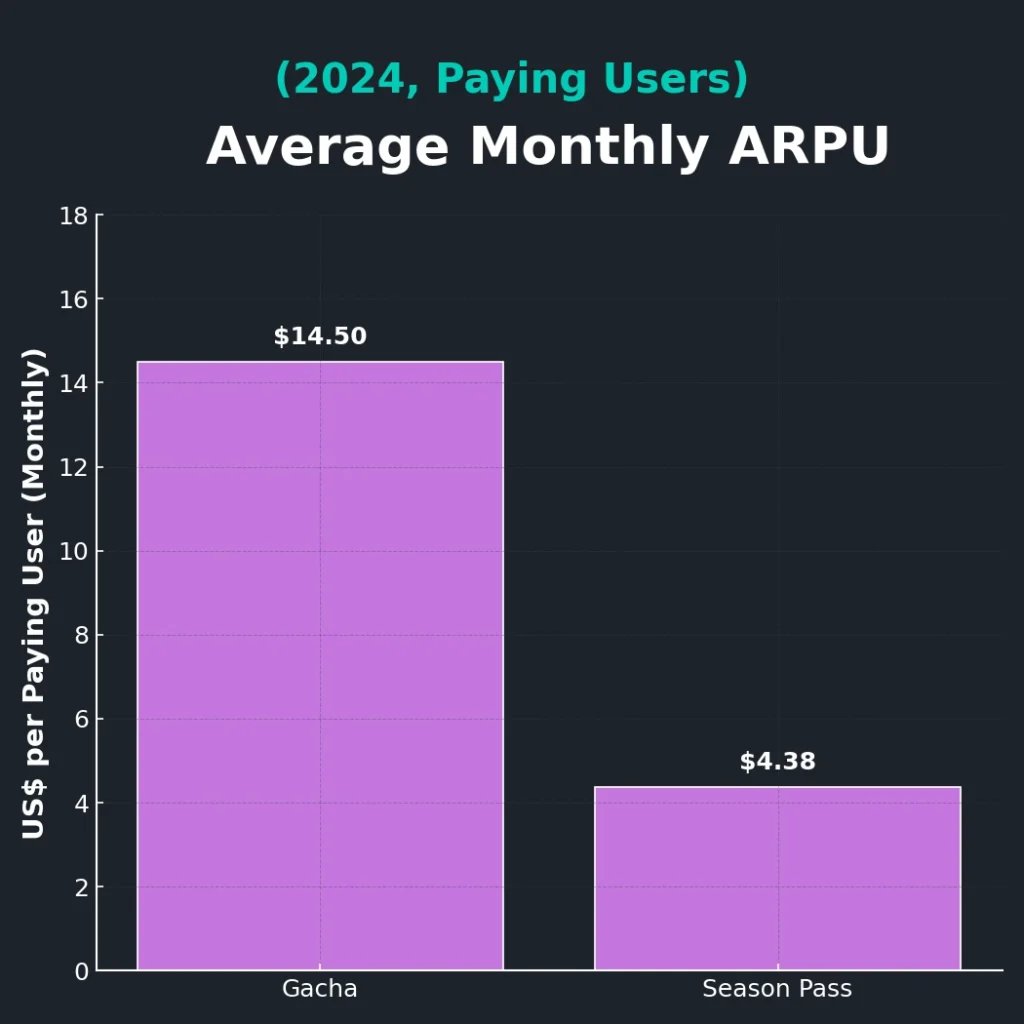

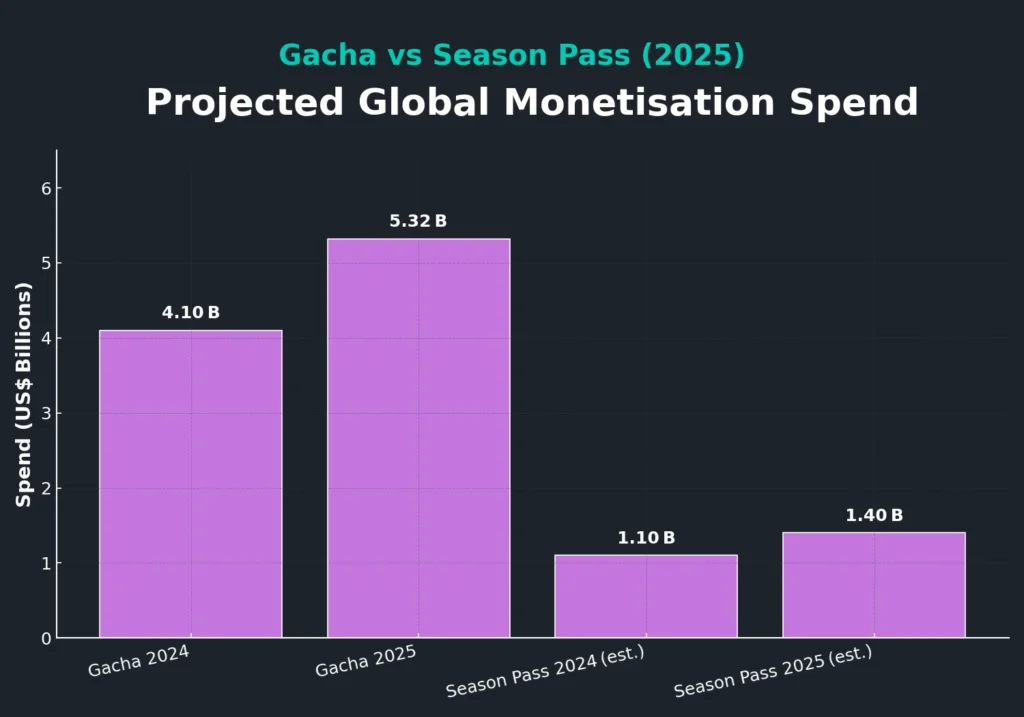

Otome publishers today have two headline ways to turn romance-obsessed players into loyal, paying fans: (1) the luck-based gacha draw and (2) the fixed-tier season/battle pass. Below is a data-driven look at how each model now performs — and where they can be combined for the best of both worlds.

The gacha economy is no niche sideline: market researchers at DataIntelo peg worldwide spend at $19.4 billion in 2023, heading for $43.2 billion by 2032 at a 9 % CAGR.

| Metric | Gacha systems | Season/Battle passes |

|---|---|---|

| 2024 global spend | US $4.1 bn | 66 % of top-grossing mobile titles now run a pass |

| 2025 outlook | US $5.32 bn (+8 %) | US $1.4 bn (est., +27 % YoY) |

| 2031-33 forecast | US $10.3 bn by 2031 (14 % CAGR) | Pass penetration expected above 80 % across genres |

Season-pass revenue is harder to isolate (because it sits inside IAP), but GameRefinery’s genre sweep shows 66 % of the top-20 % grossers now run a pass. Put crudely: if your otome title is hoping to chart, you’re competing against games that drip a paid reward track every single month.

Battle passes work because they stretch involvement over a set calendar, nudging devotees to log in daily for XP quests. Multiple case studies (Clash, Brawl Stars, PUBG Mobile) report Day-30 retention lifts of 5–10 percentage points post-pass rollout, while Appsflyer data shows hybrid mid-core titles hitting Day-90 ARPU of $9.69, comfortably ahead of pure IAP builds.

By contrast, pure gacha RPGs hover around 3–4 % Day-30 retention, because activity spikes on update days and fades fast.

Loot-box legislation from the EU to Southeast Asia keeps RNG monetisation under the microscope. A recent GameAnalytics round-up notes that players label passes “better value” than blind-box draws thanks to their transparent reward path.

For otome fans—already sensitive to romance “routes” being pay-gated—clarity matters. A pass that spells out “30 chapters · 5 CGs · 2 outfits · 1 SSR ticket” sidesteps the frustration of spending ten pulls chasing a 1.5 % banner drop.

When Paper Games layered a narrative season pass onto Light & Night (CN server) in mid-2024, AppMagic charts show:

| Metric | May 24 | June 24 (pass launch) | QoQ delta |

|---|---|---|---|

| Monthly revenue | $10.6 m | $22.7 m | ✚114 % |

| Day-30 retention | 3.9 % | 6.8 % | +2.9 pp |

While not strictly apples-to-apples, the jump illustrates the “floor-raising” effect a pass can have—even for an established gacha romance sim.

Thanks for sticking with me through this deep-dive into the numbers behind gacha and season passes. If there’s one takeaway I hope you’ll mull over, it’s this: monetisation isn’t a zero-sum duel. In 2025’s crowded otome landscape, the studios winning hearts (and wallets) are the ones daring to blend predictable, feel-good value with the thrill of the “one more pull” moment.

For more articles, click HERE.

In Tears of Themis, Stellin is your everyday currency. Expect to spend it on card upgrades, evolutions, skill levels, and more systems than you might...

If you’ve ever wondered what would happen if Disney’s most iconic villains had their own magical academy, Twisted Wonderland has the answer—and it’s every bit...

I just checked out this new otome game called A Loop Apart, and it’s got such a unique twist on the typical romance story! Imagine...